2022 Employer Health Benefits Survey

By KFF Staff

Published October 27, 2022

Section 10: Plan Funding

Section 10: Plan Funding

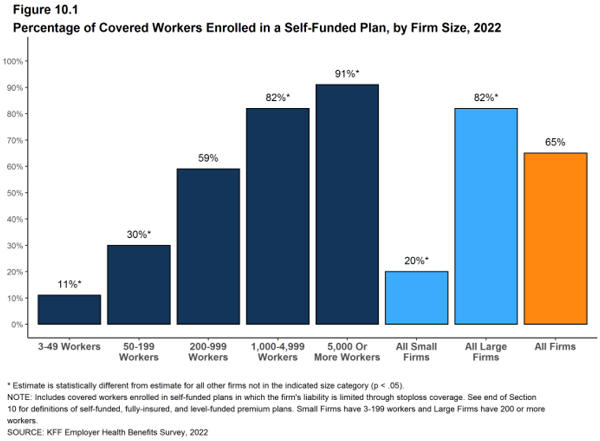

Many firms, particularly larger firms, choose to pay for some or all of the health services of their workers directly from their own funds rather than by purchasing health insurance for them. This is called self-funding. Both public and private employers can use self-funding to provide health benefits. Federal law (the Employee Retirement Income Security Act of 1974, or ERISA) exempts self-funded plans established by private employers (but not public employers) from most state insurance laws, including reserve requirements, mandated benefits, premium taxes, and many consumer protection regulations. Sixty-five percent of covered workers are in a self-funded health plan in 2022. Self-funding is common among larger firms because they can spread the risk of costly claims over a large number of workers and dependents. Some employers which sponsor self-funded plans purchase stoploss coverage to limit their liabilities.

In recent years, a complex funding option, often called level-funding, has become more widely available to small employers. Level-funded arrangements are nominally self-funded options that package together a self-funded plan with extensive stoploss coverage that significantly reduces the risk retained by the employer. Thirty-five percent of covered workers in small firms (3-199 workers) are in a level-funded plan.

SELF-FUNDED PLANS

Sixty-five percent of covered workers are in a plan that is self-funded, similar to the percentage (64%) last year [Figure 10.1] and [Figure 10.2].

* The percentage of covered workers enrolled in self-funded plans is higher than the percentage ten years ago (60%) [Figure 10.2].

* As expected, covered workers in large firms are significantly more likely to be in a self-funded plan than covered workers in small firms (82% vs. 20%) [Figure 10.1] and [Figure 10.3].

[READ FULL ARTICLE HERE]