California bill would require state review of private equity deals in healthcare

By Bernard J. Wolfson, KFF Health News

Aug. 9, 2024

A bill pending in California’s Legislature to ratchet up oversight of private equity investments in healthcare is receiving enthusiastic backing from consumer advocates and labor unions but drawing heavy fire from hospitals concerned about losing a potential funding source.

A bill pending in California’s Legislature to ratchet up oversight of private equity investments in healthcare is receiving enthusiastic backing from consumer advocates and labor unions but drawing heavy fire from hospitals concerned about losing a potential funding source.

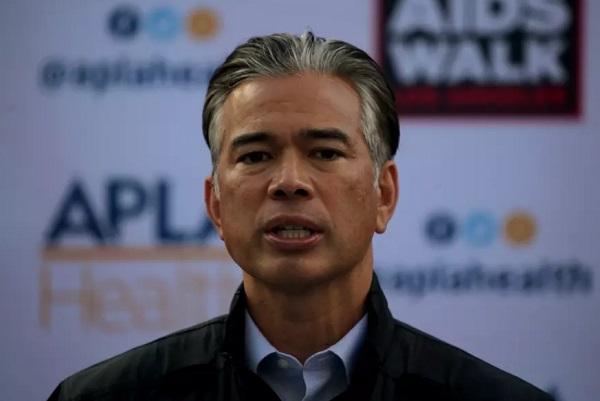

The legislation, sponsored by Atty. Gen. Rob Bonta, would require private equity groups and hedge funds to get approval from Bonta’s office for purchases of many types of healthcare businesses.

Private equity firms raise money from institutional investors such as pension funds and typically buy companies they believe can be run more profitably. They then look to boost the companies’ earnings and sell the assets for a profit.

This profit-first approach has been common in healthcare deals, and as private equity money has flooded into the sector it has set off alarms for critics and lawmakers amid mounting evidence that the deals often lead to higher prices, lower-quality care and reduced access to core health services.

Opponents of the bill, led by the state’s hospital association, the California Chamber of Commerce and a national private equity advocacy group, say it would discourage much-needed investment. The hospital industry has already persuaded lawmakers to exempt sales of for-profit hospitals from the proposed law.

“We preferred not to make that amendment,” Bonta said in an interview. “But we still have a strong bill that provides very important protections.”

The legislation would still apply to a broad swath of medical businesses, including clinics, physician groups, nursing homes, testing labs and outpatient facilities, among others. Nonprofit hospital deals are already subject to the attorney general’s review.

A final vote on the bill could come this month if a state Senate committee moves it forward.

Nationally, private equity investors have spent $1 trillion on healthcare acquisitions in the last decade, according to a report by the Commonwealth Fund. Physician practices have been especially attractive to them, with transactions growing sixfold in a decade and often leading to significant price increases. Other types of outpatient services, as well as clinics, have also been targets.

In California, the value of private equity healthcare deals grew from less than $1 billion in 2005 to $20 billion in 2021 , according to the California Health Care Foundation. And while private equity firms are tracking the pending legislation closely, they so far haven’t slowed investment in California, according to a new report from the research firm PitchBook.

Multiple studies, as well as a series of reports by KFF Health News, have documented some of the difficulties created by private equity in healthcare.

Research published last December in the Journal of the American Medical Assn. showed a larger likelihood of adverse events such as patient infections and falls at private equity-backed hospitals compared with others. Analysts say that more research is needed on how patient care is being affected but that the effect on cost is clear.

“We can be almost certain that after a private equity acquisition, we’re going to be paying more for the same thing or for something that’s gotten worse,” said Kristof Stremikis, director of Market Analysis and Insight at the California Health Care Foundation.

Most private equity deals in healthcare are below the $119.5-million threshold that triggers a requirement to notify federal regulators, so they often…

[READ THE COMPLETE ARTICLE HERE]