California health care minimum wage – New estimates for impacts on workers, patients, and the state budget

By Laurel Lucia, Enrique Lopezlira and Ken Jacobs

February 20, 2024

In October 2023, Governor Newsom signed Senate Bill 525, which will increase the minimum wage for health care workers to $25 per hour in the coming years.[1] The law sets a minimum wage for workers at most health care facilities — such as general and surgical hospitals, psychiatric hospitals, outpatient clinics, offices of physicians, and home health agencies. Workers in Skilled Nursing Facilities (SNFs) will only receive the wage increases if a separate law enacting a SNF patient care minimum spending requirement is enacted. The minimum wage applies to all low-wage workers employed by covered facilities regardless of job title — for example, medical assistants, certified nursing assistants, dietary service workers, and housekeepers — in addition to contracted and subcontracted workers if they work primarily on the premises of covered health facilities.

In October 2023, Governor Newsom signed Senate Bill 525, which will increase the minimum wage for health care workers to $25 per hour in the coming years.[1] The law sets a minimum wage for workers at most health care facilities — such as general and surgical hospitals, psychiatric hospitals, outpatient clinics, offices of physicians, and home health agencies. Workers in Skilled Nursing Facilities (SNFs) will only receive the wage increases if a separate law enacting a SNF patient care minimum spending requirement is enacted. The minimum wage applies to all low-wage workers employed by covered facilities regardless of job title — for example, medical assistants, certified nursing assistants, dietary service workers, and housekeepers — in addition to contracted and subcontracted workers if they work primarily on the premises of covered health facilities.

Wage increases will begin in June 2024 and reach the $25 minimum standard in 2026, 2027, or 2028 for the vast majority of California health care workers affected by the law. The schedule for reaching the $25 minimum hourly wage depends on industry, employer size, and other employer characteristics. For example, the $25 minimum wage is required by mid-2026 for large health systems with 10,000 full-time equivalent employees or more, dialysis clinics, and Los Angeles County health facilities, and not until 2033 for hospitals in rural areas and those predominantly providing care to Medi-Cal and Medicare patients.

This brief analyzes the impact the law is projected to have on workers, patients, and the state budget in the first year of the policy. It is an update of our June 2023 brief “Proposed health care minimum wage increase: State costs would be offset by reduced reliance on the public safety net by health workers and their families,”[2] and also builds on our April 2023 brief “Proposed health care minimum wage increase: What it would mean for workers, patients, and industry,”[3] both of which analyzed preliminary versions of the bill.

In his January 2024 budget proposal, Governor Newsom asked the Legislature to “add an annual ‘trigger’ to make the minimum wage increases subject to General Fund revenue availability, clarify the exemption for state facilities, and make other implementation clarifications.”[4] State policymakers’ discussions of possible changes to the law are still ongoing; therefore, the estimates in this brief reflect the provisions in the law as enacted in October 2023.

Impacts on workers and patients

We estimate that up to 426,000 California workers are projected to see an average annual earnings increase of $6,400 in the first year of the policy, representing a 19% increase on average compared to projected wage growth without the law. The average cumulative pay increase is projected to grow to 25% by the fourth year of implementation. The law will predominantly benefit workers of color and women, many of whom are currently struggling to make ends meet, as reported in our April 2023 brief.

The estimated number of workers affected by the law includes 322,000 workers (76%) employed directly by health care facilities and earning below the minimum standards, and 76,000 workers (18%) who will receive indirect wage increases due to spillover effects on the wages of workers in the same facilities earning somewhat above the new minimum wage. We include spillover effects for workers making up to $3 per hour above each new minimum wage based on the evidence in the economics literature,[5] and assume that indirectly affected workers will receive a quarter of the difference between their current wage and the new minimum wage. We estimate an additional 28,000 contracted workers (7%) will also receive increases because they work on-site at health care facilities and are employed by contractors such as janitorial or security firms.

We do not include estimates of horizontal wage spillover effects that could potentially materialize as a result of health facilities in the same geographic region being subject to different SB 525 implementation timelines. In other words, to what extent would health facilities with a lower minimum wage raise pay beyond what is required in the law in order to compete for workers with health facilities paying a higher new minimum wage? There is surprisingly little evidence of significant horizontal wage spillover effects in the United States.[6] A study of pay for nurses at Veterans Administration hospitals found that for every dollar wage increase, nurses at hospitals within 15 miles received a 20-cent increase in pay, and those 15 to 30 miles away received an increase of 10 cents.[7] These effects are smaller than what would already be required by the SB 525 wage schedule for employers that are given a longer timeline to reach a $25 minimum pay rate.

Increasing health care worker pay will also help to address worker shortages, turnover, and morale and improve patient care. Research has associated higher pay, reductions in worker turnover, and improved staffing levels with better quality of care for consumers, as summarized in our April 2023 brief.

Impact on the state budget

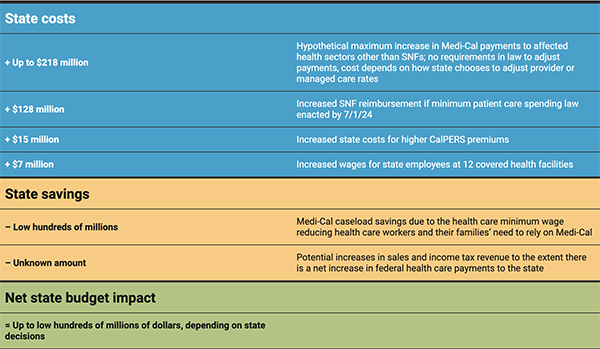

Total health care expenditures in California are projected to increase by 0.5%, or $2.7 billion, in the first year of the law, due to increased labor costs. The state will bear only a fraction of these increased expenditures through its roles as the employer of certain health care workers, the purchaser of health benefits for state employees, and the payer of Medi-Cal benefits alongside the federal government. Our estimate of the net state budget impact–up to the low hundreds of millions of dollars in Fiscal Year 2025–is summarized in Exhibit 1 and discussed in the following sections. An appendix comprehensively and systematically details our methodology and includes estimated state expenditures through Fiscal Year 2028.[8]

The estimated increase in total health care expenditures includes the wage increases for all affected workers and the associated increases in payroll taxes, workers compensation, and retirement contributions; there are also some estimated offsets due to savings for employers from lower turnover. Our cost estimate conservatively includes wage increases for Kaiser Permanente workers even though, prior to the enactment of Senate Bill 525, Kaiser Permanente and the Coalition of Kaiser Permanente Unions agreed to…

[READ THE COMPLETE ARTICLE HERE]