Insurers Are Abandoning Homeowners Over Wildfire Risk But Investing in Big Oil

By Derek Seidman , Truthout

January 30, 2025

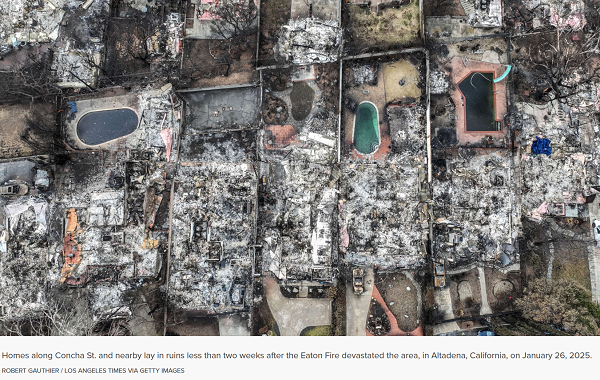

The massive Los Angles fires, stoked by climate change, have been devastating for thousands of displaced homeowners and renters whose dwellings have been damaged or destroyed. The full costs of the catastrophe are still emerging but will surely run into the tens of billions of dollars.

The massive Los Angles fires, stoked by climate change, have been devastating for thousands of displaced homeowners and renters whose dwellings have been damaged or destroyed. The full costs of the catastrophe are still emerging but will surely run into the tens of billions of dollars.

The fires have once again thrown the growing crisis of the U.S. insurance industry into the media spotlight. Rising extreme weather events are contributing to skyrocketing insurance premiums for homeowners, and insurers are pulling out en masse from entire swaths of the country, including California. The home insurance system is teetering.

And yet, despite the fossil fuel industry’s clear role in driving the intensifying extreme weather that is upending home insurance for millions and denting industry profits, insurance companies remain committed to underwriting and investing in fossil fuels. In California, top insurers like State Farm, a focus of anger for Angelenos, have billions in oil and gas holdings, and are among the top shareholders of oil giants like ExxonMobil and Chevron, even as they decline to renew thousands of insurance policies across the state — including, last year, in the Pacific Palisades neighborhood at the center of the fires.

Fossil fuel-tied insurers facing losses and fleeing markets is now an old story reproduced anew with every latest extreme weather event.

“The insurance industry has the option of cutting exposure to fossil fuel expansion overnight,” Risalat Khan, senior strategist with Insure Our Future, a leading campaign focused on the insurance industry’s ties to the climate crisis, told Truthout. “But rather than doing that, they’re continuing to play both sides.”

Fossil Fuels, Extreme Weather and the Insurance Crisis

By broad consensus, climate change is helping to drive the rise and intensity of extreme weather events. The most authoritative global source on the impact of climate change, the Intergovernmental Panel on Climate Change (IPCC), has concluded as an “established fact” that “human-induced greenhouse gas emissions” have increased the frequency and intensity of extreme weather.

The IPCC also concluded with “high confidence” that fire weather conditions “will become more frequent in some regions at higher levels of global warming.” A recent scientific study found that the frequency of “extreme [wildfire] events” increased by “2.2-fold from 2003 to 2023, with the last 7 years including the 6 most extreme.”

Equally indisputable is the core driver of climate change: the burning of fossil fuels whose emissions heat up and pollute the atmosphere, accounting “for over 75 percent of global greenhouse gas emissions and nearly 90 percent of all carbon dioxide emissions,” according to the United Nations.

Rising extreme weather events like wildfires, flooding and hurricanes are causing an existential crisis within the home and property insurance industry. Unwilling or unable to simultaneously insure homeowners facing extreme weather events and also turn a big enough profit, insurance corporations are increasingly jacking up premiums or exiting regions altogether.

Climate change is not the sole driver of this insurance industry crisis, but it may be the main one. A recent report by Insure Our Future found that “over one-third of weather-related insured losses over the last two decades, totaling $600 billion, can be attributed to climate change,” and that the “climate-attributed share of insured weather losses rose from 31% to 38% over the last decade on average.”

Insurance Industry Props Up Fossil Fuels

Yet, many insurance companies remain committed to propping up the fossil fuel industry — increasingly, their own gravedigger — as both insurers and investors. The fossil fuel industry could not proceed with business as usual, including its ongoing expansion, without the critical services that insurance companies provide in underwriting everything from…

[READ THE COMPLETE ARTICLE HERE]