Majority of debtors to US hospitals now people with health insurance

By Jessica Glenza

January 11, 2024

People with health insurance may now represent the majority of debtors American hospitals struggle to collect from, according to medical billing analysts.

This marks a sea change from just a few years ago, when people with health insurance represented only about one in 10 bills hospitals considered “bad debt”, analysts said.

“We always used to consider bad debt, especially bad debt write-offs from a hospital perspective, those [patients] that have the ability to pay but don’t,” said Colleen Hall, senior vice-president for Kodiak Solutions, a billing, accounting and consulting firm that works closely with hospitals and performed the analysis.

“Now, it’s not as if these patients across the board are even able to pay, because [out-of-pocket costs are] such an astronomical amount related to what their general income might be.”

Although “bad debt” can be a controversial metric in its own right, those who work in the hospital billing industry say it shows how complex health insurance products with large out-of-pocket costs have proliferated.

“What we noticed was a breaking point right around the 2018-2019 timeframe,” said Matt Szaflarski, director of revenue cycle intelligence at Kodiak Solutions. The trend has since stabilized, but remains at more than half of all “bad debt”.

In 2018, just 11.1% of hospitals’ bad debt came from insured “self-pay” accounts, or from patients whose insurance required out-of-pocket payments, according to Kodiak. By 2022, the proportion who did (or could) not pay their bills soared to 57.6% of all hospitals’ bad debt.

Kodiak receives every billing transaction for more than 1,800 hospitals across the US, a little less than one-third of all hospitals in the country. It was able to perform the analysis by looking at this in-house database.

The cost of healthcare in the US is a perennial political concern – it eats up more than 18% of gross domestic product, far more, and often for worse health outcomes, than in other peer democracies. As much as 31% of the cost of US healthcare is probably driven by the administration of complex bills that now beset the public.

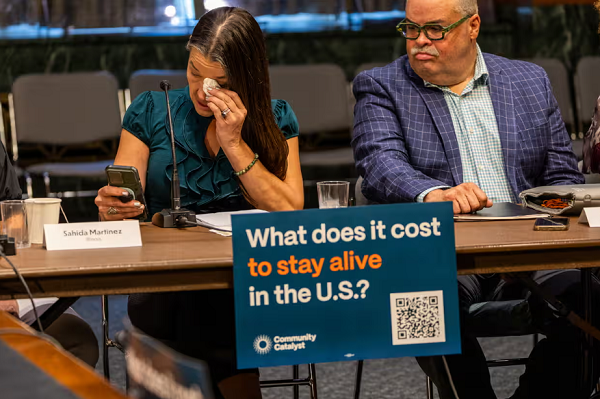

Now, medical debt and its impact on Americans’ lives is an issue of increasing political perseveration. A recent investigation by KFF Health News and NPR found more than 100 million Americans have medical debt of some kind, debt which often forces families to make heart-wrenching sacrifices.

In part, those sacrifices are driven by hospitals’ extraordinary collection practices. Hospitals refer patients to aggressive debt collectors, use state courts to garnish wages, place liens on people’s homes and report debt to credit agencies, which can drastically worsen future job and housing prospects. Although there are some attempts to rein in these practices, billing analysts like Szaflarski say they do not address the core issue – health plans designed by insurers which force hospitals to become debt collectors.

“These stories really grind my gears,” said Szaflarski. “The idea of patient responsibility” – those deductibles and coinsurance requirements – “was not an idea created by healthcare providers. They were vehicles created by payers,” referring to insurers.

[READ FULL ARTICLE HERE]