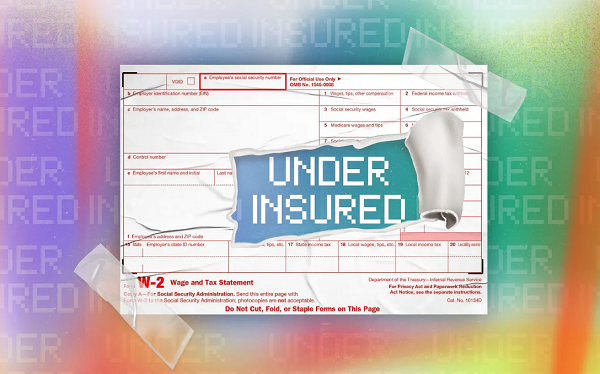

New Study: Even Subsidized Job-Based Health Insurance Has Become Unaffordable

By Wendell Potter

Apr 08, 2025

A new study from the Commonwealth Fund confirms a pain that millions of American workers already know: having employer-based health insurance (or job-based, as the study calls it) is no guarantee that workers are protected from financial ruin if they get sick or injured.

A new study from the Commonwealth Fund confirms a pain that millions of American workers already know: having employer-based health insurance (or job-based, as the study calls it) is no guarantee that workers are protected from financial ruin if they get sick or injured.

The study, How Affordable Is Job-Based Health Coverage for Workers?, distills the costs of employer-sponsored insurance (ESI) across all 50 states and D.C. It shows that even with growth in income outpacing rising deductibles, premiums and out-of-pocket costs are still consuming an outsized share of low- and middle-income workers’ paychecks.

Folks are feeling the squeeze. Nearly a quarter of the U.S. families with employer-based coverage spent more than 10 percent of their household income just on premiums and deductibles in 2023. That doesn’t even count copays or coinsurance. In Mississippi, single workers are shelling out more than 5 percent of their income just to pay their share of premiums. Add deductibles into the mix, and it’s clear: Tens of millions of American workers are underinsured by any meaningful standard.

This new data adds hard numbers to something that has been gut-wrenchingly obvious to many of us for years. It’s also one of the main reasons I left my executive job in the insurance industry.

Before I became a whistleblower, I worked for Cigna. Not long before I left, the company made a major shift: It eliminated all low- or zero-deductible plans for its own employees and pushed everyone into high-deductible plans. And Cigna didn’t stop there — it encouraged all of its corporate customers to follow suit. Many did.

Why? Because these plans are highly profitable for insurers. They shift more costs to the patient and the taxpayer. That means insurers keep more of the premiums while families end up with unaffordable bills for care they thought their insurance would cover.

“Even with financial copay assistance from drug manufacturers, patients and patient families come to find out that these payments don’t count toward their deductible,” Caryl Harris co-founded of Avery’s Hope said. “They end up paying just as much if not more out-of-pocket over the long term. There is something undeniably unfair and marginalizing about that.”

And this is exactly why I helped form and now lead the Lower Out-of-Pockets (LOOP) NOW Coalition. We’re a group of more than 100 organizations — including patient advocacy groups, physician associations, health reform advocates and even some forward-thinking employers — united in our demand that policymakers, insurers and employers do something about this crisis.

The Commonwealth Fund study makes several important policy recommendations. Among them: allow ntage lobbyist…

[READ THE COMPLETE ARTICLE HERE]