What to Watch in the 2024 ACA Open Enrollment

by Cynthia Cox, Kaye Pestaina, Krutika Amin, and Jared Ortaliza

Oct 30, 2023

With the start of the 2024 Affordable Care Act open enrollment, the Marketplaces have been operating for a full decade and are heading into their eleventh year. This year’s open enrollment season will last from November 1, 2023 to January 16, 2024 in most states and longer in some state-based marketplaces. (Due to the federal holiday on January 15, state marketplaces are allowed to extend the deadline for Open Enrollment to January 16.) Even after a decade of operation, there continue to be changes in these markets. Here’s what to watch in 2024:

With the start of the 2024 Affordable Care Act open enrollment, the Marketplaces have been operating for a full decade and are heading into their eleventh year. This year’s open enrollment season will last from November 1, 2023 to January 16, 2024 in most states and longer in some state-based marketplaces. (Due to the federal holiday on January 15, state marketplaces are allowed to extend the deadline for Open Enrollment to January 16.) Even after a decade of operation, there continue to be changes in these markets. Here’s what to watch in 2024:

- Unsubsidized premiums in the ACA Marketplaces are rising due in part to inflation. Premiums are rising by an average of 5% in 2024 for the second-lowest cost silver plan (the benchmark against which subsidies are calculated). Premiums for the lowest cost bronze plans (the least expensive plans on the Marketplaces) are similarly rising 6%. (State-level data are available here). An earlier KFF analysis of premium rate filings found the primary drivers of premium growth heading into 2024 are rising prices paid to health care providers, driven in part by inflation in the rest of the economy, and a rebound in utilization coming out of the pandemic. However, other factors like the reduced use of COVID-related care are having a downward effect on premiums. Although unsubsidized premiums are rising, the Inflation Reduction Act’s temporary enhancement of subsidies continues to make the vast majority of Marketplace shoppers eligible for financial help with the cost of coverage. These subsidies cap how much enrollees must spend on a benchmark silver plan premium as a share of their household income, meaning that most enrollees will be sheltered from the increases in the sticker price of the premium.

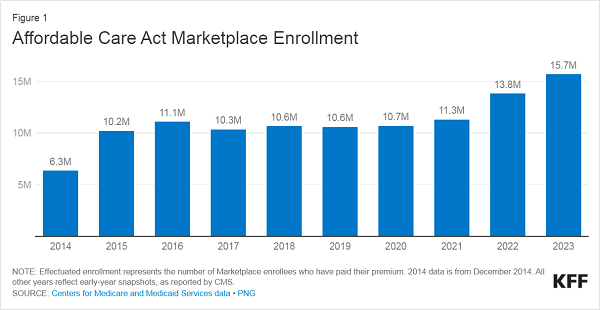

- 2024 could be another record-setting year for enrollment. The number of people who enrolled in Marketplace coverage earlier this year reached 15.7 million, surpassing prior record-setting years in 2021 and 2022. During the pandemic, state Medicaid programs suspended annual renewal requirements for Medicaid and kept everyone continuously enrolled. Now, states are resuming renewal requirements and will end Medicaid coverage if people are no longer eligible or if they do not complete renewal forms (sometimes called “procedural reasons”). So far this year, more than 9.5 million adults and children have been disenrolled from Medicaid and CHIP, mostly due to procedural reasons, and millions more will likely be disenrolled in the coming months. Some may find themselves eligible for Marketplace subsidies, further boosting enrollment in the coming year, though there may be challenges in ensuring people losing Medicaid are aware of their options for coverage through the Marketplaces.

- Insurer participation in 2024 will be more robust than in recent years. There are more insurers entering new markets than there are plans exiting from the Marketplace. Notably, Oscar Health is withdrawing from the California individual insurance market after profits fell short of expectations. Cigna is also exiting from Kansas’s and Missouri’s markets. At the same time, other insurers are entering several states, such as California, Colorado, Delaware, Indiana, Maryland, Nevada, New Jersey, New Mexico, Oklahoma, Pennsylvania, South Carolina, Utah and Wisconsin.

- State-level policy changes will affect what coverage some residents are eligible for, how much it costs, and how they sign up. For example, Virginia plans to start using its own enrollment platform with the 2024 open enrollment cycle, rather than relying on the federal Healthcare.gov platform. California will begin offering additional cost-sharing reduction subsidies that eliminate deductibles and lower other out-of-pocket expenses for about 4 in 10 Covered California enrollees. Massachusetts is increasing the income limit for additional state subsidies. Washington is allowing undocumented immigrants to enroll in Marketplace plans with state income-based subsidies starting in 2024. And North Carolina will expand Medicaid starting December 1, 2023, to residents with incomes up to 138% of the poverty level. Some low-income people enrolled in Marketplace plans in North Carolina will move to Medicaid.

- A new auto-reenrollment policy on Healthcare.gov will save some consumers money on their deductibles. People who are enrolled in Marketplace plans now and who do not act during Open Enrollment to renew or change their coverage will, in many cases, be automatically reenrolled by the Marketplace on December 16 so coverage will continue in 2024. In the past, people were usually automatically re-enrolled in the same plan. This year, the federal Marketplace (healthcare.gov) will first check to see if people currently enrolled in bronze plans have income at or below 250% of the federal poverty level, which would make them eligible for a cost-sharing reduction…